Insights & Blogs

Liquidity Elixir: Loan Against Mutual Funds

How much physical gold one can keep at Home?

Celebrating 21 years of multi-asset Fund 🎉

The Power of Compounding & Patience, Nano Blog

Liquidity Elixir: Loan Against Mutual Funds

How much physical gold one can keep at Home?

Celebrating 21 years of multi-asset Fund 🎉

The Power of Compounding & Patience, Nano Blog

All Categories

Recent Posts

Liquidity Elixir: Loan Against Mutual Funds

How much physical gold one can keep at Home?

Celebrating 21 years of multi-asset Fund 🎉

Connect with us to check your

"Financial Fitness"

Blogs

Insights & Blogs

We are committed to crafting a secure and prosperous future for you.Liquidity Elixir: Loan Against Mutual Funds

Do you know how much time it takes to take a loan or credit line Read MoreHow much physical gold one can keep at Home?

As per The Central Board of Direct Taxes (CBDT) following is the limit of physical Read More 03May

admin0 Comments

03May

admin0 Comments

Celebrating 21 years of multi-asset Fund 🎉

🎉Celebrating 21 years of ICICI Prudential Multi Asset🎉, consistent compounder since 2002, 🎖️ Launched at Read More 14Dec

admin1 Comment

14Dec

admin1 Comment

The Power of Compounding & Patience, Nano Blog

There are many variations of but the majority have simply free text. Read MoreLiquidity Elixir: Loan Against Mutual Funds

How much physical gold one can keep at Home?

Celebrating 21 years of multi-asset Fund 🎉

The Power of Compounding & Patience, Nano Blog

Recent Posts

Kirtan Bhatt0 CommentsLiquidity Elixir: Loan Against Mutual Funds

admin0 CommentsHow much physical gold one can keep at Home?

admin0 Comments

admin0 Comments

Celebrating 21 years of multi-asset Fund 🎉

Connect with us to check your

"Financial Fitness"

Talk to an expert

admin

Personal Finance

admin

Personal Finance

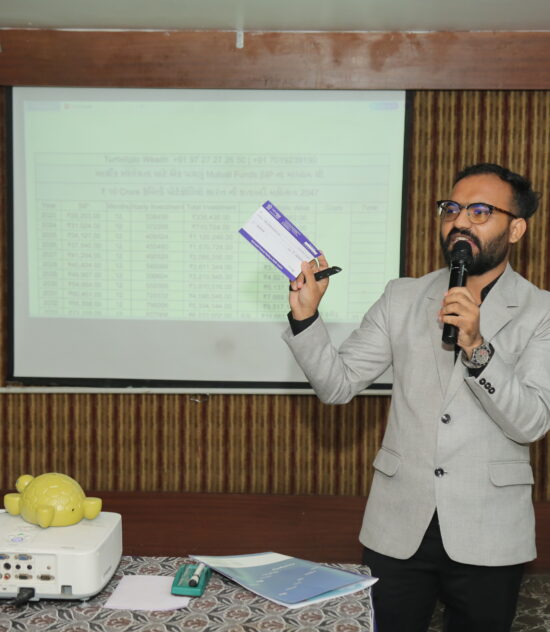

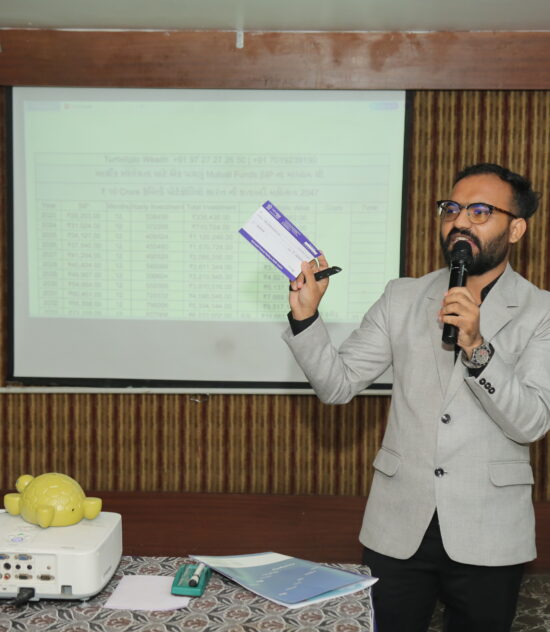

Celebrating 21 years of multi-asset Fund 🎉

🎉Celebrating 21 years of ICICI Prudential Multi Asset🎉, consistent compounder since 2002, 🎖️

Launched at the NAV of Rs. 10 🐥, it has grown to the NAV of Rs. 545 🍲 (as on 31st Oct.'23).

It means NAV has grown by 18.68% on annual basis year on year.

It has seen:

2008's Sub Prime Crisis GFC, 😨

2018'S slow down, 👇

2020' Covid 🏥

2022' Russia Ukraine 🔫

2023' Middle East War

And all government changes in the last 20 years.

A simple SIP of Rs. 10,000 from 2002 till now, the portfolio value is Rs. 2,15,00,000 ( 2 Crore 15 Lakhs) with the investment of Rs. 25.2 Lakhs ( 25 lakhs). Nearly 9 times of total investment with SIP.

This is the power of SIP, Diversification and Patience.

Now the main thing which matters is, Who all made the money or created the wealth in the last 20 years?

The answer is: very few.

Now it's the time we decide what our next 20 years should look like and what amount of portfolio you want to see in the next 20 years, because the market will create wealth for the disciplined investors. 🤑

Regards,

Kirtan Bhatt

Turtlefolio Wealth

In the pursuit to make you wealthy. 💵

Liquidity Elixir: Loan Against Mutual Funds

Do you know how much time it takes to take a loan or credit line Read MoreHow much physical gold one can keep at Home?

As per The Central Board of Direct Taxes (CBDT) following is the limit of physical Read More 03May

admin0 Comments

03May

admin0 Comments

Celebrating 21 years of multi-asset Fund 🎉

🎉Celebrating 21 years of ICICI Prudential Multi Asset🎉, consistent compounder since 2002, 🎖️ Launched at Read More 14Dec

admin1 Comment

14Dec

admin1 Comment

The Power of Compounding & Patience, Nano Blog

There are many variations of but the majority have simply free text. Read MoreRecent Posts

Kirtan Bhatt0 CommentsLiquidity Elixir: Loan Against Mutual Funds

admin0 CommentsHow much physical gold one can keep at Home?

admin0 Comments

admin0 Comments